Retirement Planning, Simplified.

Self-help tools and resources powered by AI. Navigate your retirement with confidence.

Advertisement

Weekly Market Pulse

Mixed Signals as Tech Earnings Surprise Upside

Markets remain range-bound as strong technology sector earnings compete with persistent inflationary pressures. The overall sentiment leans slightly bullish, but volatility is expected to continue through the quarter.

What It Means for Retirees

- Tech volatility highlights the importance of rebalancing.

- Interest rate uncertainty suggests maintaining a cash buffer.

- Look for value opportunities in defensive sectors.

Tools for Informed Decisions.

Forecast

Calculator to estimate portfolio growth under different market scenarios.

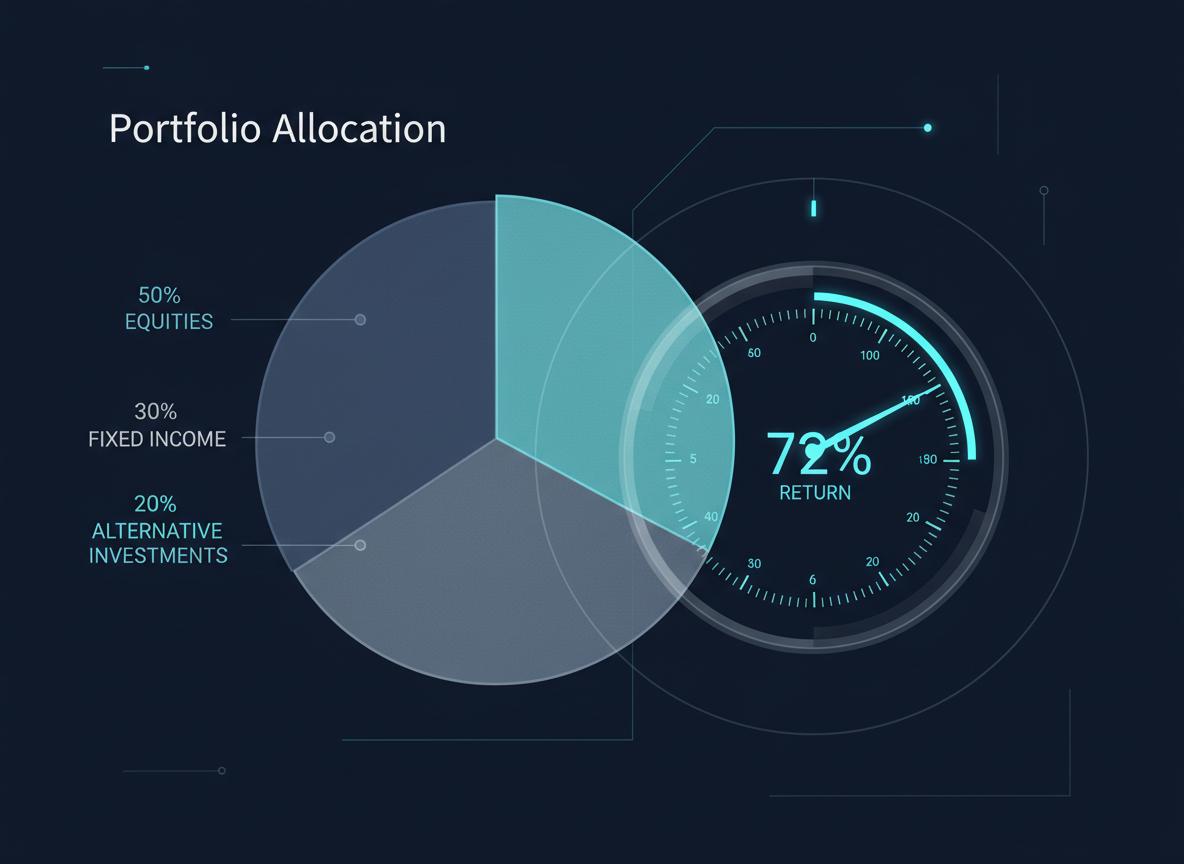

Rebalance

Calculate optimal asset allocation adjustments based on your target.

Protect

Explore strategies for risk management and sequence-of-returns mitigation.

Retirement Academy

Educational resources to help you understand the rules, risks, and strategies of retirement planning.

The Mathematics of Safety: Sequence of Returns Risk

Why the first 5 years of retirement are critical, and how a market downturn early on can impact your portfolio's longevity.

RMDs Demystified: The Rules of Withdrawal

Understanding Required Minimum Distributions (RMDs) is essential to avoid hefty IRS penalties. Here is what you need to know about the current age limits and calculations.

IRMAA: The Hidden Medicare Tax

Earning too much in retirement can spike your Medicare premiums. Learn about IRMAA brackets and how a Roth conversion strategy might save you thousands.

Social Security: The 8% Bonus

Should you claim at 62 or 70? Using your 401(k) to bridge the gap can essentially 'buy' you a guaranteed 8% annual return from the government.

Precision Planning for Your Next Chapter.

Set your retirement age, income goal, and risk preference. Our free tools model thousands of scenarios to help you find the plan that fits your life.

Advertisement

Timing Matters. So Does Clarity.

See the impact of starting now versus later. Our free tools translate time into dollars—no spreadsheets required.

Complexity Simplified.

A single view of your retirement timeline, contributions, and cash flow—all from free, easy-to-use tools.

Your Privacy Matters.

No account required. No personal data stored. Our tools work right in your browser—your information stays with you.

Advertisement

Retirement Planning Should Be Democratized.

For too long, professional-grade financial tools were locked behind expensive advisor fees (often 1% of your wealth per year). We believe you deserve better.

401kTimer combines the processing power of AI with the proven principles of growth and income investing. We provide the intelligence; you make the decisions.

AI-First Analysis

We use advanced algorithms to process market data, stripping away human bias and emotional noise.

Unbiased & Free

No hidden fees, no assets under management (AUM) charges. Just pure, data-driven tools.

Community Focused

Built for the 10,000 Americans retiring every day who deserve better than generic advice.

Join Thousands Planning Smarter.

"I finally understand when I can retire. The free tools gave me clarity I couldn't find elsewhere."

Linda M.

Early retiree, 58

"The weekly newsletter breaks down complex topics into simple, actionable advice. Highly recommend!"

David R.

Engineer, 52

"It's like having a financial educator in my inbox—no sales pitch, just pure value."

Susan T.

Small business owner, 61

Get Free Retirement Insights.

Weekly tips on growth investing, income strategies, and retirement planning. No spam, unsubscribe anytime.